Rice Genomics and Genetics 2015, Vol.6, No.5, 1-10

6

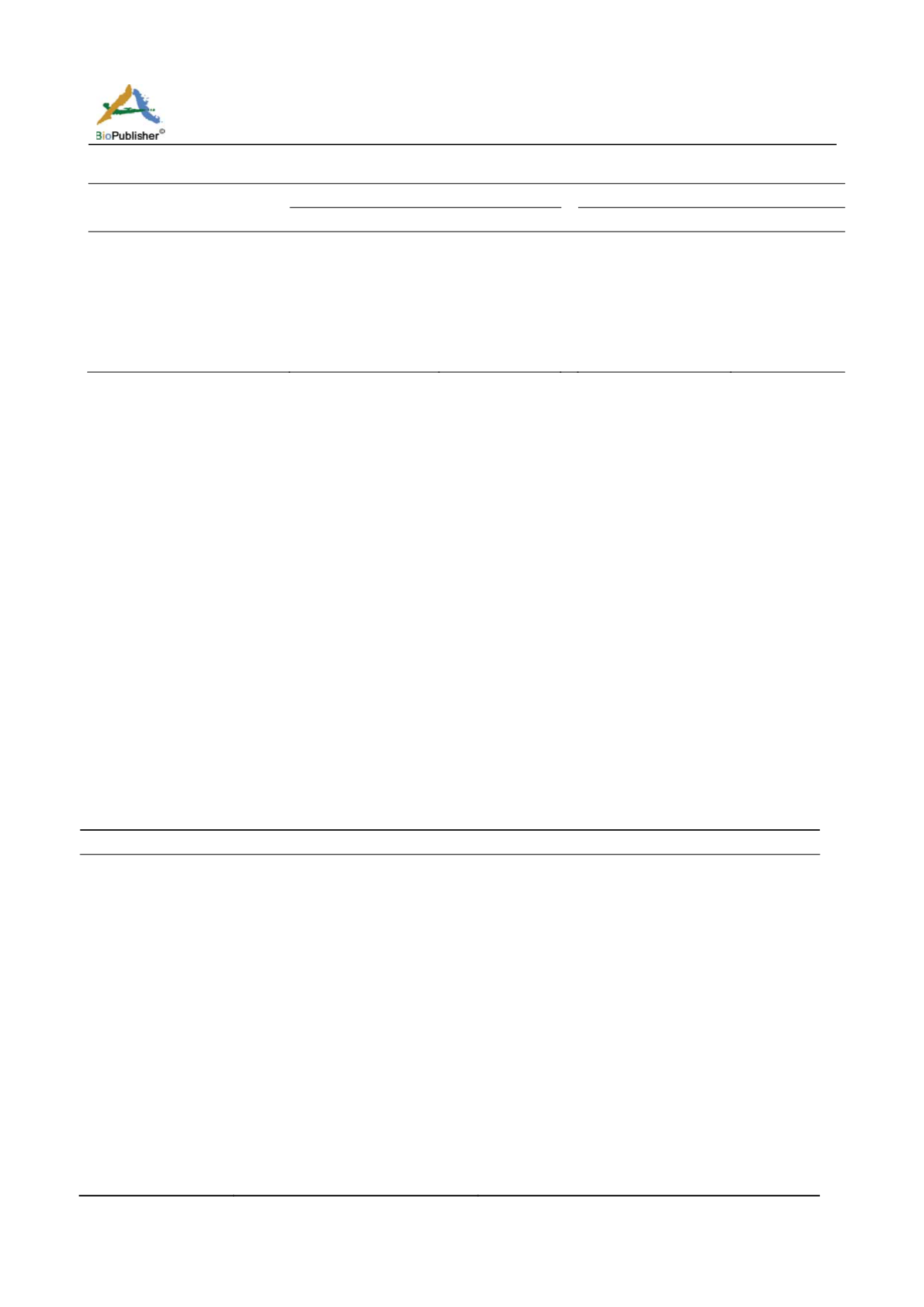

Table 3 Results of Econometric Integration of Price Series

Variables

Price level 1(0)

First difference 1(1)

Market price series

ADF statistics

PP statistics

ADF statistics

PP statistics

Ekiti

-1.4409

-1.6042

-11.5337

-19.2139

Lagos

-1.0567

-1.7997

-8.8527

-41.2822

Ogun

-1.3519

-1.5975

-18.9991

-30.5026

Ondo

-1.5214

-1.6406

-11.6777

-18.4598

Osun

-1.2456

-2.2268

-8.9768

-43.6053

Oyo

-0.9827

-0.9979

-14.7398

-14.7208

Notes: Critical values are -3.4870 and -3.4861 at the 99% and -2.8859 and -2.8861 at the 95%. Confidence levels for price level and

first difference series, respectively. Source: Compiled from results of stationarity test. If the absolute value of the ADF or PP is lower

than their critical statistics, we fail to reject the null hypothesis of non-stationarity. Confidence levels for price level and first

difference series, respectively. Source: Compiled from results of stationarity test. If the absolute value of the ADF or PP is lower than

their critical statistics, we fail to reject the null hypothesis of non-stationarity.

As discussed in the methodology section, this meant

that all price data were integrated of order one I(1), a

requirement for Johansen’s co-integration analysis

(Johansen and Juselius, 1990; Juselius, 2006).

To bolster our findings concerning the I(1) and I(0)

nature of the price series at their levels and their first

differences, respectively, the Phillip-Perron (PP) test

was also conducted. The PP test, like the ADF test,

indicated significance for all variables, rejecting the

null hypothesis of stationarity at the 1% and 5% levels

of significance. The findings here were in accordance

with earlier findings and conclusion that food

commodity price series are mostly stationary of order

one i.e. I(1) (Mafimisebi, 2001; Okoh and Egbon,

2003; Mafimisebi 2008, 2012). According to

Mafimisebi (2012), the result is probably explained by

the fact that most food price series have trends in them

owing to inflation which culminates in such data

exhibiting mean non-stationarity.

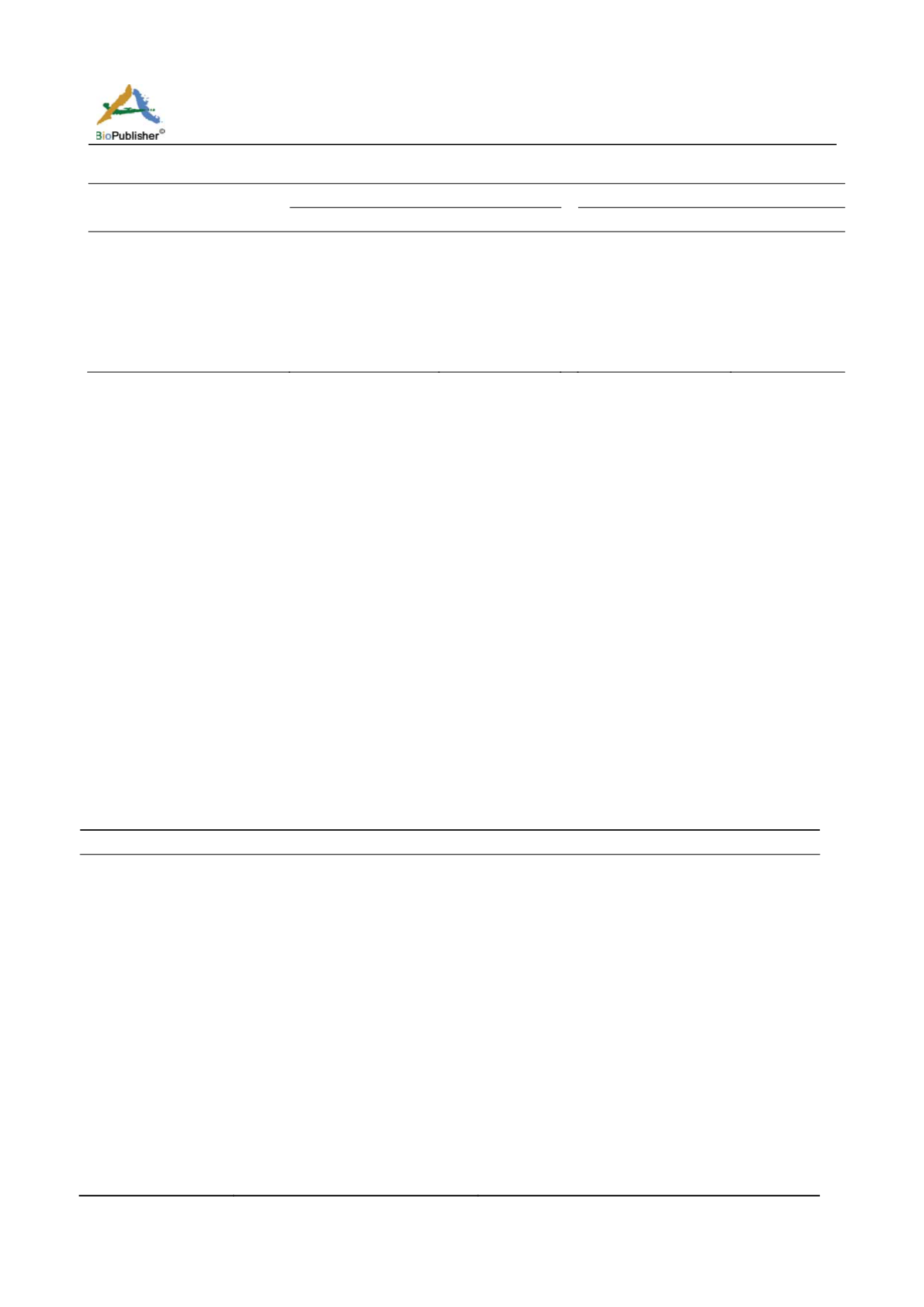

4.1.5. Results of Long-run Integration Test

The co-integration test results for market pairs were

presented in Table 4. Generally, the results indicated

price co-integration at 5% level of significance by

rejecting the null hypothesis in favour of the alter-

native, in fourteen (14) out of fifteen (15) market pairs.

Table 4 Result of Pair-wise Co-integration Test of Imported Rice Market

Market Pairs

Trace Test Statistics

Maximal Eigenvalue Test Statistics

Pi-Pj

Lagos/Ogun

23.202**

21.580**

Lagos/Ondo

32.814**

30,488**

Lagos/Osun

32.670**

30.495**

Lagos/Oyo

44.403**

43.417**

Lagos/Ekiti

36.982**

34.581**

Ogun/Osun

17.928*

16.235*

Ogun/Oyo

15.734*

14.762*

Ogun/Ekiti

19.665*

17.747*

Ondo/Osun

42.905**

40.593**

Ondo/Oyo

25.799**

24.519**

Ondo/Ekiti

52.470**

50.049**

Osun/Oyo

27.985**

26.859**

Osun/Ekiti

Ekiti/Oyo

49.625**

34.806**

47.554**

33.484**